BlackRock deposited around 2,563 Bitcoin worth $173 million and 49,852 Ethereum valued at $97 million into Coinbase Prime on Friday amid a surge in redemptions from its flagship crypto funds, per Arkham Intelligence.

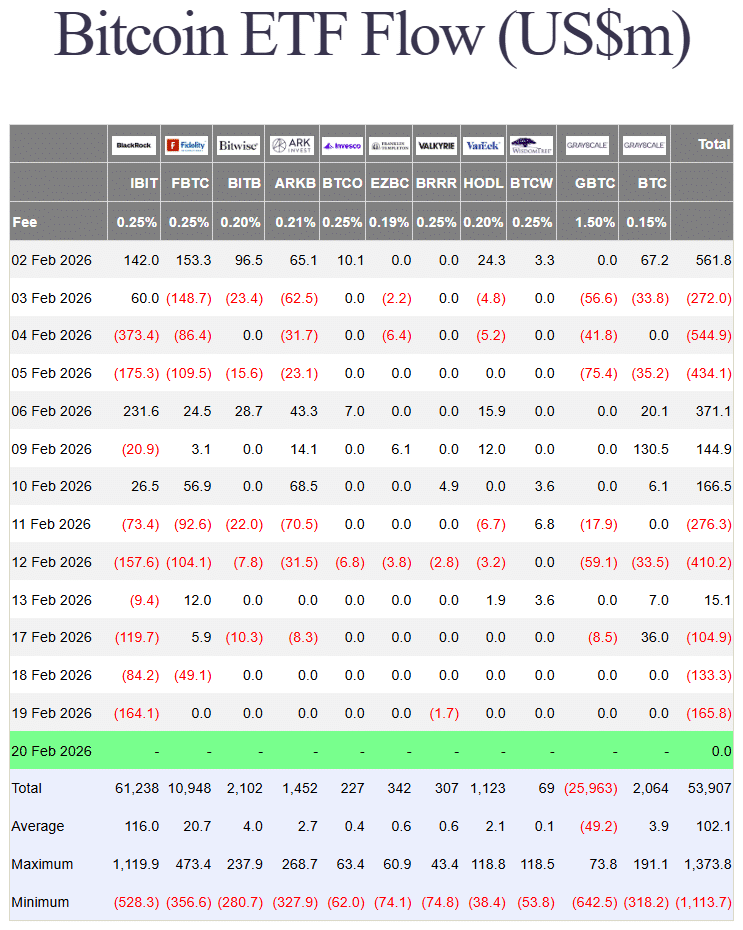

According to Farside Investors, BlackRock’s spot Bitcoin ETF (IBIT) saw about $368 million in net outflows over the past three days, driving most of the $404 million withdrawn from all 11 US Bitcoin ETFs.

Its Ethereum fund (ETHA) shed $104 million during the same stretch.

BlackRock’s transfers typically support the creation and redemption of ETF shares, a routine process that adjusts fund supply based on investor demand. Moving large amounts of assets is not always a signal to sell, however.

These transfers follow a crypto market rebound after a White House meeting on stablecoin yields with banks and crypto firms, part of the market structure bill discussions. White House negotiators are pushing banks to accept a framework allowing limited stablecoin rewards, signaling the administration’s intent to accelerate crypto integration with traditional finance.

Bitcoin surged past $68,000 while Ethereum approached $2,000 following the meeting. Bitcoin is now trading at around $67,500, up 1.4% in the past 24 hours, per CoinGecko.