Bitcoin has struggled to regain upward momentum in recent sessions. The price has remained range-bound amid uncertain macro conditions. Volatility in equities and rate expectations has capped recovery attempts.

With short-term signals mixed, attention shifts to long-term holders, or LTHs. This cohort has historically shaped major Bitcoin reversals. Their behavior now offers critical insight into whether BTC is nearing a turning point.

Sponsored

Bitcoin LTHs Have a Critical Support Established

The LTH CBD Heatmap highlights significant supply density above $65,000. This cluster is anchored in the 2024 first-half accumulation range. That zone has repeatedly absorbed recent selling pressure. Strong demand there suggests conviction among experienced Bitcoin holders.

This support band has acted as a buffer during pullbacks. Capital accumulated during prior consolidation phases remains largely dormant. As long as this structure holds, large-scale distribution appears unlikely.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A decisive breakdown below this range would change the narrative. It could open the path toward Bitcoin’s Realized Price, currently near $54,000. However, such a move seems less probable while LTH supply remains stable. The data suggests holders are not preparing for capitulation.

Sponsored

How Are LTHs Reacting?

The Long-Term Holder Net Unrealized Profit and Loss, or NUPL, has recently declined. This metric measures aggregate unrealized gains within long-term wallets. Falling NUPL indicates shrinking profitability among this BTC cohort.

Historically, extended NUPL declines have coincided with deeper price corrections. Similar patterns appeared in February 2020 and June 2022. In those periods, weakening profitability led to broader capitulation events.

Sponsored

This cycle appears different. Institutional flows and spot Bitcoin ETF support have strengthened structural demand. Persistent inflows from regulated products provide a stabilizing force. As a result, LTHs may be less inclined to exit positions despite margin compression.

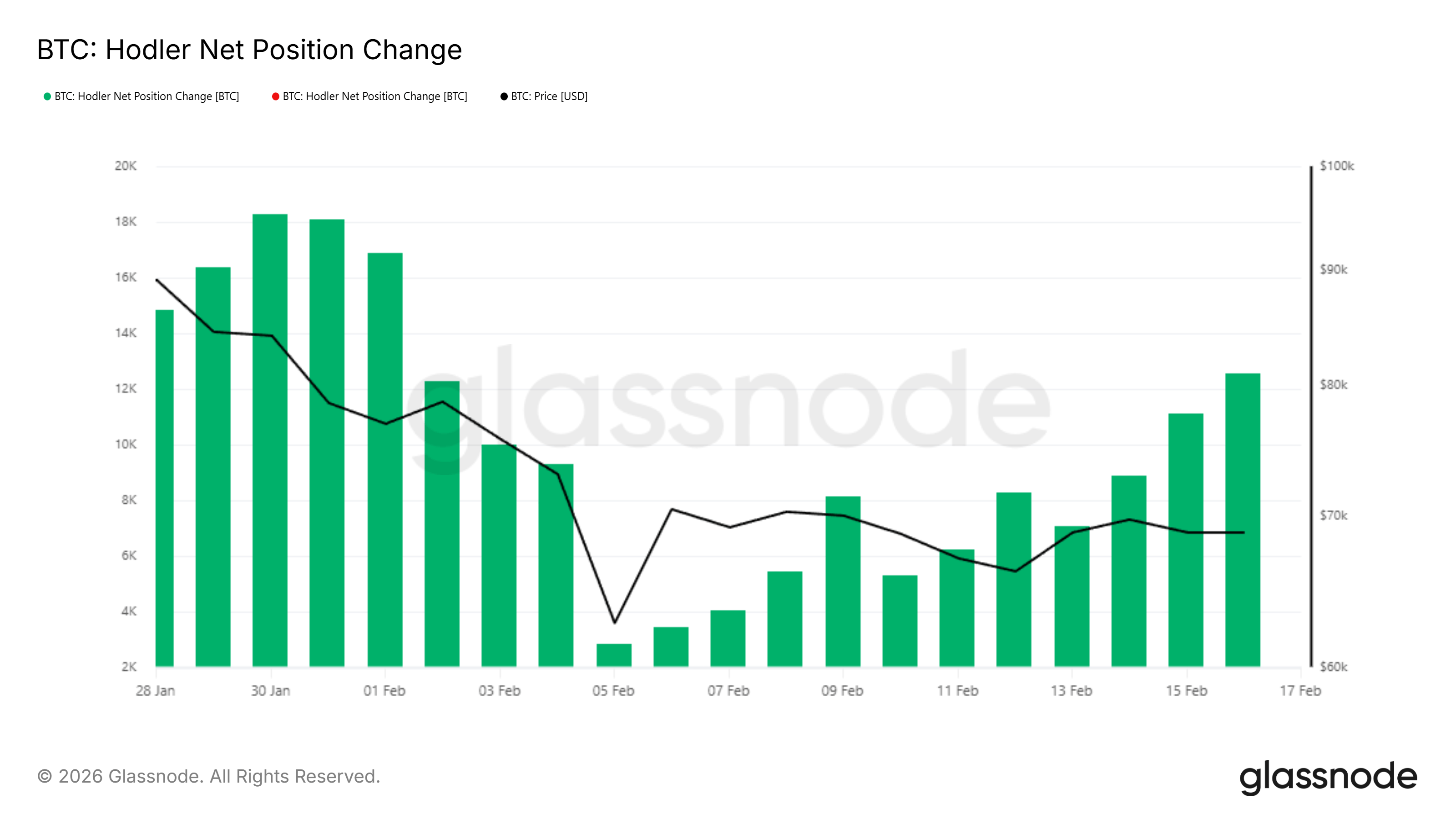

HODLer Net Position Change data shows Bitcoin LTHs are accumulating rather than distributing. Rising green bars on the metric suggest coins are moving into long-term storage. This is a positive sign as their accumulation tends to stick for a long while, unlike STHs, who are prone to selling at the first sign of profits.

Continued inflows into LTH wallets reinforce this trend. Accumulation during uncertainty can slow downside momentum, and if this pattern persists, it may help establish a foundation for a broader Bitcoin price recovery.

Sponsored

BTC Price Is Still Under Resistance

Bitcoin is trading at $68,282 at the time of writing. The primary near-term target remains reclaiming the $70,000 level. This psychological barrier has capped upside for roughly ten days.

The $68,342 support level is critical in the short term. Strong defense of this zone could enable BTC to challenge the $70,610 resistance. A confirmed breakout may extend gains toward $73,499 and potentially higher if momentum accelerates.

Downside risk remains present under adverse macro conditions. A break below $65,158 would weaken the current structure. Losing that support could expose Bitcoin to a deeper retracement. In such a scenario, price could gravitate toward the Realized Price near $58,000.