The XMR price climbed nearly 10% on Tuesday following the release of a new report by TRM Labs highlighting Monero’s resilience and growing adoption in privacy-focused markets despite delistings from major exchanges.

The research sheds light on the increasing use of Monero in high-risk environments, including darknet marketplaces, while also revealing subtle network-layer behaviors that could influence real-world privacy assumptions.

Monero’s Shadow Market Growth and Network Insights Drive XMR Price Surge

As of this writing, XMR was trading for $335.66, up by nearly 10% in the last 24 hours.

Sponsored

Sponsored

According to TRM Labs, Monero’s on-chain transaction activity remained broadly stable in 2024–2025 and consistently higher than pre-2022 levels.

This trend persisted despite restrictions from leading platforms such as Binance, Coinbase, Kraken, and Huobi, which have increasingly limited access to XMR due to regulatory and traceability concerns.

“Despite exchange delistings and enforcement pressure, XMR activity on Monero remains above pre-2022 levels,” TRM Labs noted.

According to the firm’s research:

- 48% of new darknet markets in 2025 were XMR-only.

- Most ransomware payments still occur in BTC — liquidity matters.

- 14–15% of Monero peers show non-standard network behavior.

Monero’s cryptography remains strong, but network-layer dynamics can influence real-world privacy assumptions.

The report emphasizes that Monero’s resilience is not primarily driven by casual retail trading. Instead, it reflects a core user base that actively seeks privacy-preserving transactions, even when faced with higher friction, fewer on-ramps, and reduced liquidity.

Sponsored

Sponsored

Transaction volumes in 2024 and 2025 were materially higher than in early 2020–2021, indicating sustained demand rather than sporadic, speculative spikes.

This stability is particularly notable given that, according to some reports, 73 exchanges delisted Monero in 2025 alone.

As a result, liquidity for XMR is increasingly concentrated on offshore or lower-compliance venues, which partially explains why most ransomware payments still occur in Bitcoin.

While actors frequently request Monero for its privacy features, Bitcoin remains easier to acquire, move, and convert at scale.

Sponsored

Sponsored

Monero Adoption on the Rise Among Darknet Markets

Meanwhile, the report also acknowledges that Monero’s adoption in darknet markets continues to grow.

TRM Labs data shows that 48% of newly launched darknet marketplaces in 2025 now support XMR exclusively, a sharp increase compared to previous years.

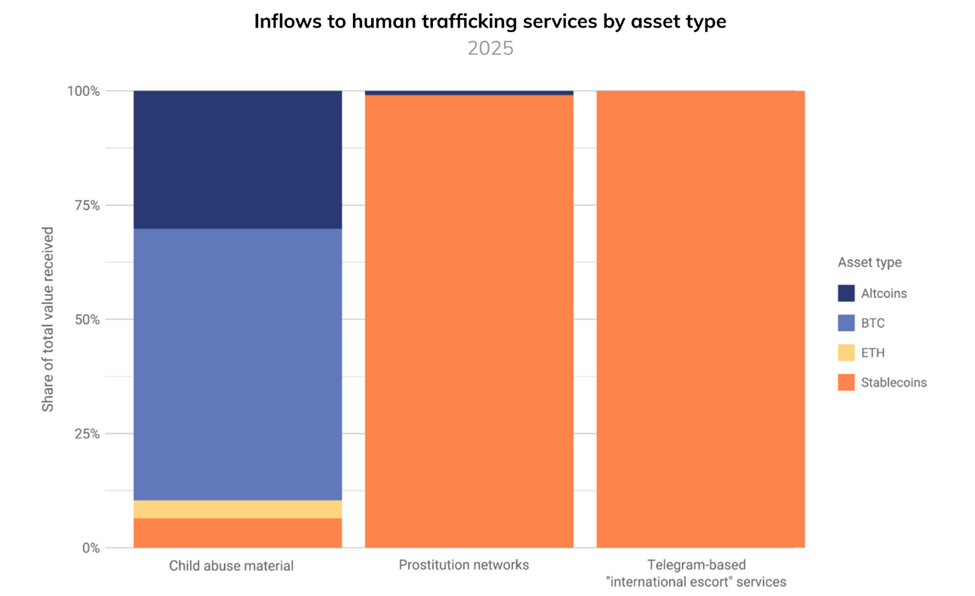

This trend is especially pronounced in Western-facing markets, reflecting a direct response to enhanced tracing capabilities on Bitcoin and US dollar-backed stablecoins.

It aligns with a recent BeInCrypto report, which cited the increasing use of XMR in illegal activities.

Sponsored

Sponsored

Network-Layer Insights With Privacy in Practice

Beyond market behavior, TRM Labs conducted empirical research into Monero’s peer-to-peer (P2P) network. The analysis found that 14–15% of reachable Monero peers displayed non-standard behavior, including:

- Irregular message timing

- Handshake patterns, and

- Infrastructure concentration.

While these anomalies do not indicate protocol failures or malicious activity, they highlight how network-layer dynamics can subtly affect theoretical anonymity models, even as Monero’s on-chain cryptography remains strong.

Monero occupies a unique position in the crypto ecosystem. While transparent networks and stablecoins have become increasingly traceable and regulated, Monero continues to offer privacy-preserving functionality that appeals to users operating in high-risk or privacy-conscious environments.

TRM Labs’ findings highlight both the strengths and nuances of Monero’s privacy design. It shows that real-world usage patterns and network behavior can affect the practical efficacy of anonymity protections.